One of the most important metrics for SaaS companies is your customer lifetime value. Understanding this metric can help you strategize your business growth and nurture high-opportunity customers. Here’s everything you need to know about how to calculate CLV and what your numbers mean.

What Is Customer Lifetime Value?

Customer lifetime value (CLV) is how much you earn from a single customer over the length of the relationship. It can be used to estimate the average value of a customer relationship and to predict the value of future customer relationships. For SaaS companies, CLV is a useful metric to understand the quality of both your solution and your customer experience.

How to Calculate CLV

There are a number of ways to calculate CLV, depending on what you sell, how much data you have, and how accurate you need your calculation to be.

In the case of a SaaS company, the simplest way to calculate CLV is to find your average monthly customer value and multiply it by the average lifespan of a customer in months. For example, the CLV of a software company with an average monthly value of $2250 and an average lifespan of 2 years (24 months) would be $54,000.

What Does Customer Lifetime Value Tell Us?

CLV helps companies make better business development, sales and marketing, and retention decisions. It helps quantify the amount of time and money they should invest in gaining or renewing a customer. And, it can be used to forecast profit by comparing CLV to average customer acquisition cost.

Segmented CLV

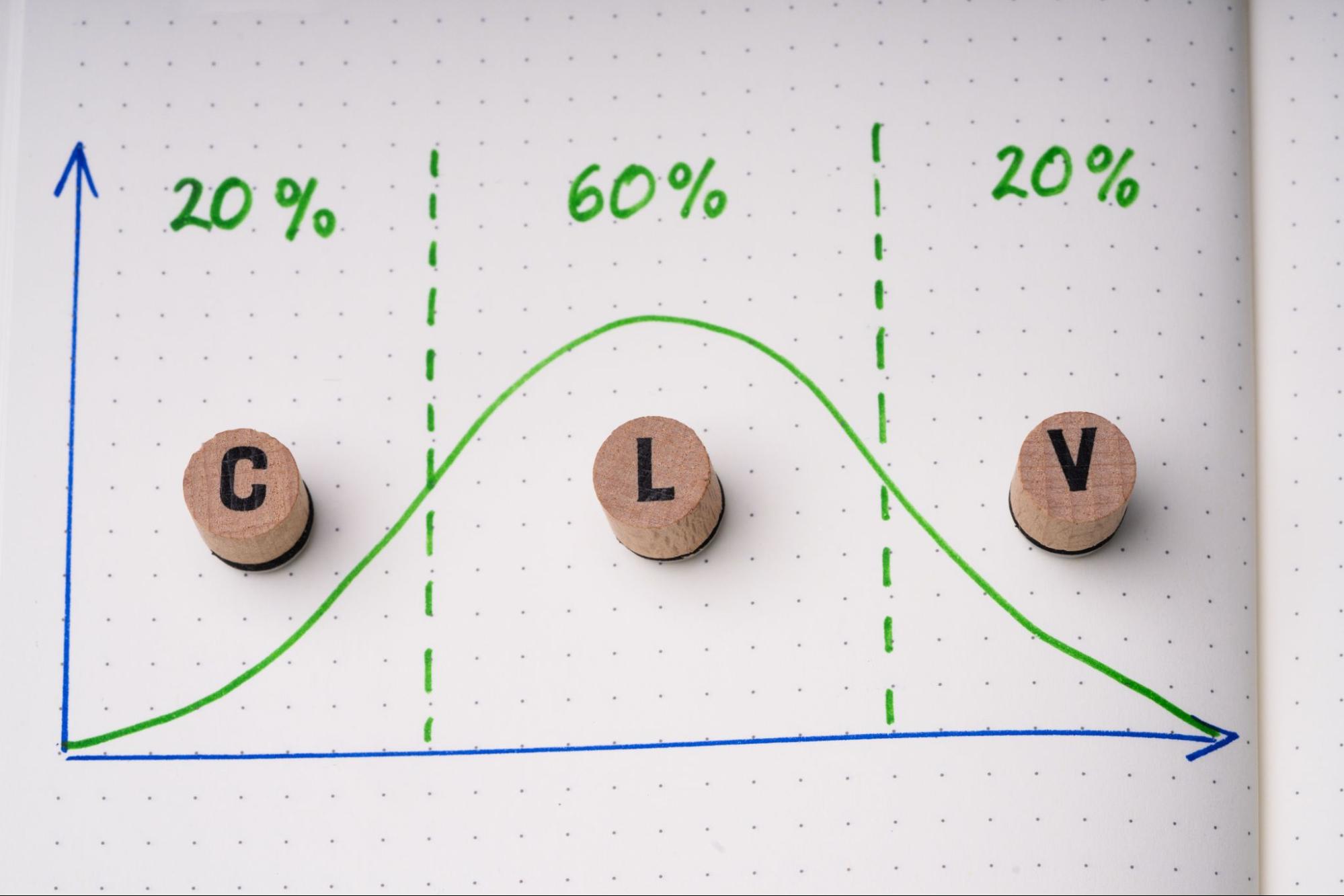

Finding your overall CLV is helpful for understanding your overall profitability, but it can provide so much more information with just a few extra calculations. One of the most helpful ways to break down CLV is by customer segment. This might include looking at CLV by software pricing tier, industry, or company size.

You can calculate average CLV based on these segments to get insights on what your best customers have in common as well as what increases or decreases CLV for your particular business.

How Can CLV Improve Customer Retention?

Knowing and understanding your CLV (especially by segment) can help you improve your overall customer retention and ideally, profit. With an accurate sense of your CLV, you can identify:

- Shared characteristics of your highest and lowest value customers

- Common drop-off points

- Key customers and accounts

- Best- and worst-performing sales and marketing tactics

These commonalities can help you make strategic changes to improve your customer retention and avoid overinvesting in new business.

Get Insights on Cross-Selling & Upselling Opportunities

By knowing your customer lifetime value, you can identify customers who have a longer than average lifespan but a lower than average value. These customers offer prime opportunities for upselling, cross-selling, and overall account growth.

Reduce or Avoid Customer Acquisition Costs

Knowing your CLV can also help you reduce or altogether avoid high customer acquisition costs. Since you know the expected value of a customer, you can set an acquisition budget to prevent overspending when signing a new customer and ensure long-term profit.

You can also identify customers who are similar or dissimilar from your ideal (high CLV) customers early on. Maybe your data shows that companies of over 500 people have a high monthly value but a short customer lifespan, causing a low CLV. Looking at the data qualitatively, you see that these customers often up outgrowing your offering faster than you can add the features they need, so they may not be worth extensive (and expensive) pursuit.

This knowledge enables you to put more time into your strongest relationships, provide additional training, take in critical feedback from key customers, and more.

Increase Customer Value

Once you know your average CLV, you can see if it’s enough to sustain your company and turn profit. You can also narrow in on key accounts to grow and explore common traits of successful customers to take on new business intentionally.

And, CLV can even help you make strategic company decisions. When monthly customer value and customer lifespan are both high, an increased CLV can let you know it’s time to raise prices or add new features.